Offshift Taps Chainlink to Provide Oracle Feeds for Its zkAsset Private Pegs

Offshift’s Public Testnet Phase Two Is Now Live With Chainlink Oracles Integration.

Private DeFi, storage and staking protocol Offshift has integrated Chainlink’s market-leading decentralised oracle network to securely and reliably bring accurate, transparent, real-time price data from the off-chain world to the Offshift ecosystem on Ethereum. This allows users to mint, burn, and trade zkAssets based on a fair market price of the underlying collateral at the time of the shift, leading to private digital assets within DeFi.

Offshift developers have completed the oracle integration on Ethereum’s Rinkeby testnet.

With the launch of phase two of the Offshift public testnet, the community can now try shifting between two assets pegged using Chainlink oracles.

The new testnet dashboard can be found here , and a step-by-step walkthrough is linked here .

Decentralised oracles are an integral part of the Offshift ecosystem. At the protocol’s core is a feature called shifting, which allows users to move back and forth between Offshift’s native ERC-20 token XFT, and private, asset-pegged zkERC-20 tokens. The initial integration includes Chainlink’s BTC/USD and XAU/USD price feeds and is already live.

For these shifts to be made possible, and to ensure shifted assets are accurately pegged, the smart contracts that execute them must have the ability to retrieve real-time market data aggregated from a multitude of off-chain sources. This data must be accurate, transparent, and secured against manipulation.

The “ oracle problem ” is the inability of smart contracts to natively retrieve data or “know” of events that occur in the real world. Chainlink solves the oracle problem using the industry’s most secure and reliable blockchain middleware, referred to as oracles, for connecting on-chain and off-chain environments.

One of Chainlink’s popular oracle solutions is its Price Feeds, which are the most widely used in the DeFi industry, securing over $3B in USD value for many leading dApps like Synthetix, Aave, and yEarn. Chainlink’s Price Feeds are decentralized oracle networks made up of numerous independent security reviewed nodes that collectively source prices from a variety of high-quality off-chain data aggregators like CoinGecko and BraveNewCoin. This ensures that DeFi applications relying on these price feeds have highly accurate, available, and tamperproof data feeds without any single point of failure in the sourcing or delivery of that data.

After surveying the oracle solutions available on the market, the Offshift team made the decision to make Chainlink its exclusive provider of oracle price feeds, ensuring our zkAssets are highly secure and reliable DeFi products.

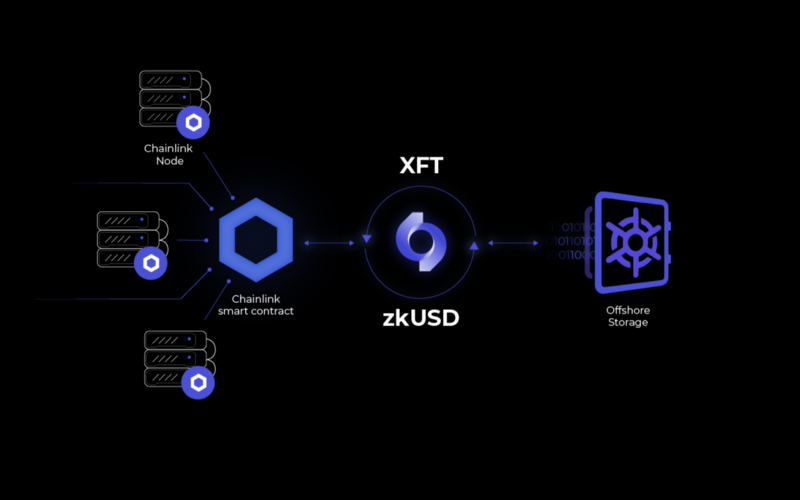

Integration Overview

The diagram above shows how Offshift’s Chainlink integration brings off-chain data on-chain to be used by Offshift’s smart contracts for pegging zkAssets.

The process begins in the center of the diagram when the Offshift zkUSD contract is called to execute a shift from XFT to zkUSD.

Since external data is required to complete the shift function (in this case the required data is the current XFT/USD price), the zkUSD contract prepares a request for the data, then calls the Chainlink oracle contract with the request.

The Chainlink oracle contract notifies its network of independent nodes of the request. The nodes then acquire the requested data and relay it back to the oracle contract.

The oracle contract calls back the zkUSD contract with the data it’s received from Chainlink’s node network, and the zkUSD contract completes the shift by minting an amount of zkUSD that’s equal in value to the XFT that was burned to initiate the shift.

The user who initiated the shift receives his or her zkUSD tokens in the output address specified, and they’re now free to move the assets privately about the Offshift ecosystem.

“Privacy is a core human right, and DeFi users should have the ability to obtain privacy for their financial transactions on the blockchain. We’re thrilled to bring privacy to the DeFi ecosystem thanks to an integration with Chainlink, which ensures that Offshift assets are minted, burned, and pegged according to the fair market value as reported by Chainlink’s secure and reliable aggregated data feeds.”

— Johnny, Project Lead at Offshift

About Offshift

Offshift is leading private decentralized finance (PriFi) with the world’s first Private Derivatives Platform. It leverages zero-knowledge (zk) proofs and sources reliable, real-time price feeds from Chainlink’s decentralized oracle network to enable users to mint zkAssets, an unprecedented line of fully private synthetics. Offshift’s mostly anonymous team has developed a trusted reputation for their thorough privacy research, development and execution.

To learn more and get involved, visit the links below:

Website | Telegram | Discord | Twitter | Instagram | Uniswap | Sushiswap

About Chainlink

If you’re a developer and want to quickly get your application connected to Chainlink Price Reference Data, visit the developer documentation and join the technical discussion in Discord . If you want to schedule a call to discuss the integration more in-depth, reach out here .

Chainlink is an open-source blockchain abstraction layer for building and running decentralized oracle networks that give your smart contract access to secure and reliable data inputs and outputs. It provides oracles to leading DeFi applications like Synthetix, Aave, and Bancor; numerous blockchains such as Ethereum, Polkadot, and Tezos; as well as large enterprises including Google, Oracle, and SWIFT.

Website | Twitter | Reddit | YouTube | Telegram | Events | GitHub | Price Feeds | DeFi