Offshift SushiSwap Dual-Liquidity Mining Goes Live

Stake Your SLP Tokens Now to Earn Rewards in XFT and SUSHI.

After polishing and fine-tuning our staking platform, we are excited to open our Sushiswap LP Rewards Program to the public. The rewards program officially launches today, March 19, 2021, and will culminate March 19, 2022.

In addition to the 80,000 XFT which will be distributed in staking rewards over the course of the year — including 10,000 XFT in the opening month — users will also be eligible to receive SUSHI rewards, as per Offshift’s recent acceptance into the Sushiswap Onsen rewards program.

We are further pleased to announce that using our first-of-its-kind proprietary Dual-Staking contract , users can now receive rewards denominated in both XFT and SUSHI simultaneously when they stake their SLP tokens at dashboard.offshift.io .

To get staking, dive into our detailed staking guide below.

To begin, you’ll need equal amounts of XFT and ETH to provide liquidity on SushiSwap. For example, if you have $200 worth of XFT, you’ll also need $200 worth of ETH to provide liquidity. Additionally you’ll need some ETH for transaction fees.

I. Provide liquidity on SushiSwap

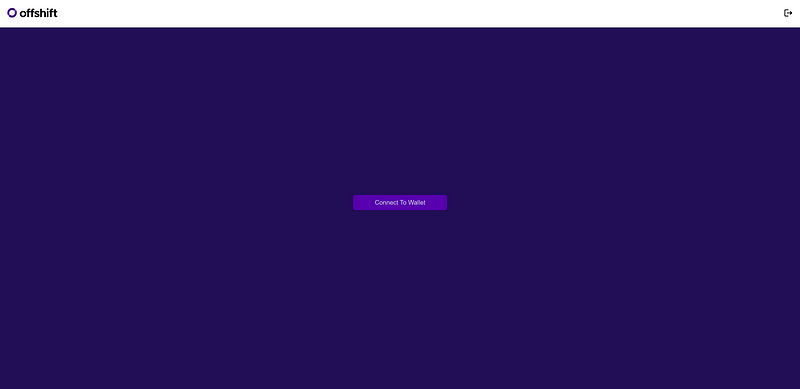

1. Navigate to SushiSwap’s XFT-ETH page . Click “Connect to a wallet,” choose your wallet provider (generally MetaMask), and then select your wallet containing XFT and ETH.

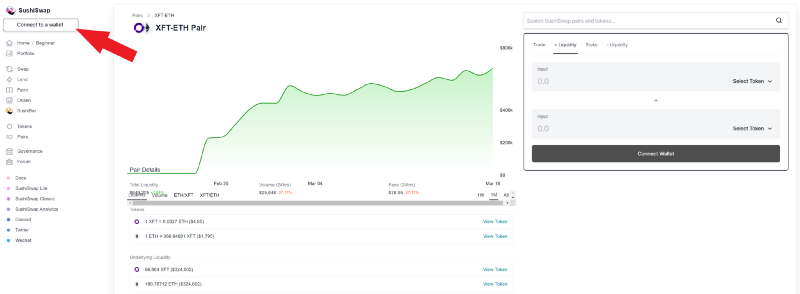

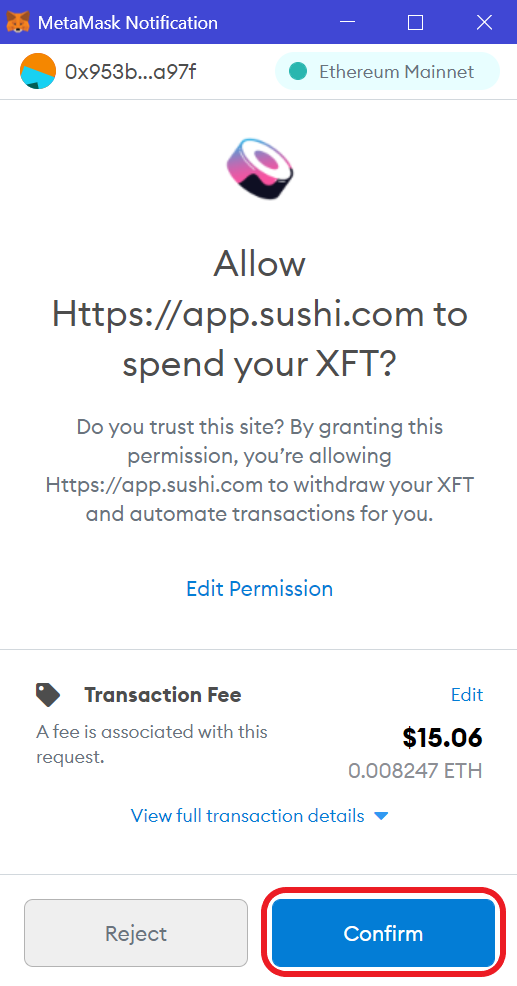

2. Select the “+ Liquidity” tab, make sure XFT and ETH are selected, and then click “Approve XFT.”

3. MetaMask will open and ask if you want to Allow https://app.sushiswap.com to spend your XFT? Click “Confirm.”

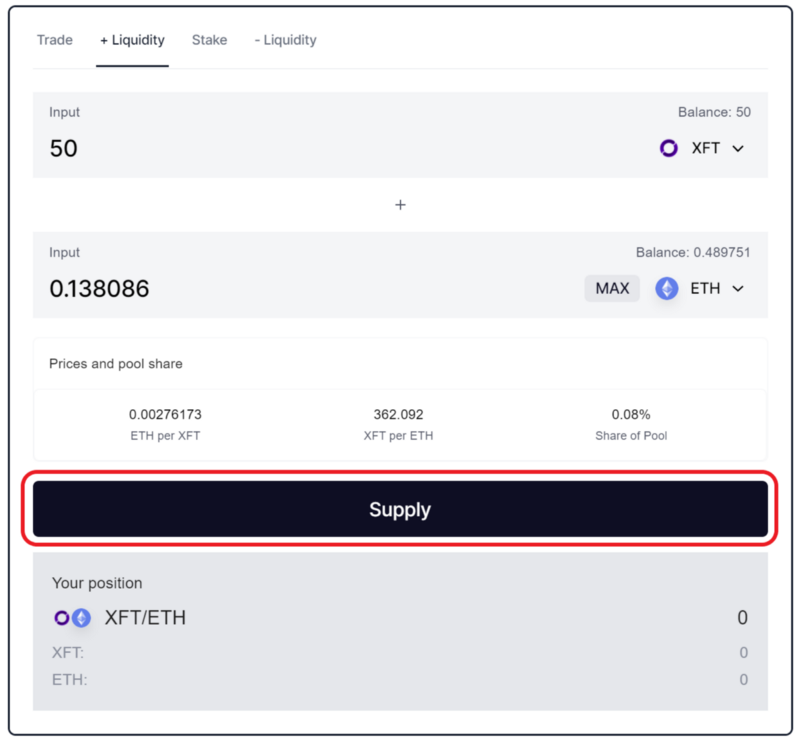

4. Once the approval transaction has been confirmed by the network, the “Supply” option will become enabled, as in the image below. Click “Supply.”

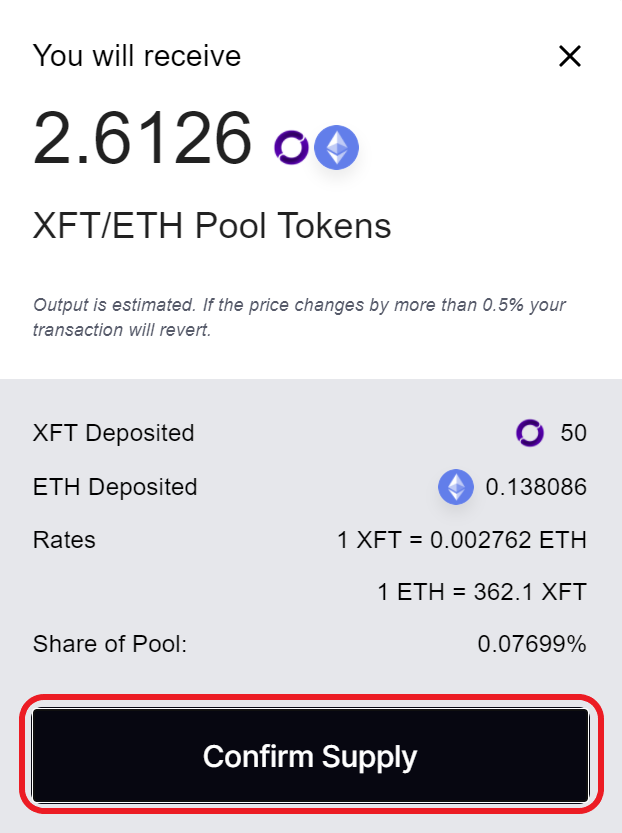

5. An output summary will pop up. Click “Confirm Supply.”

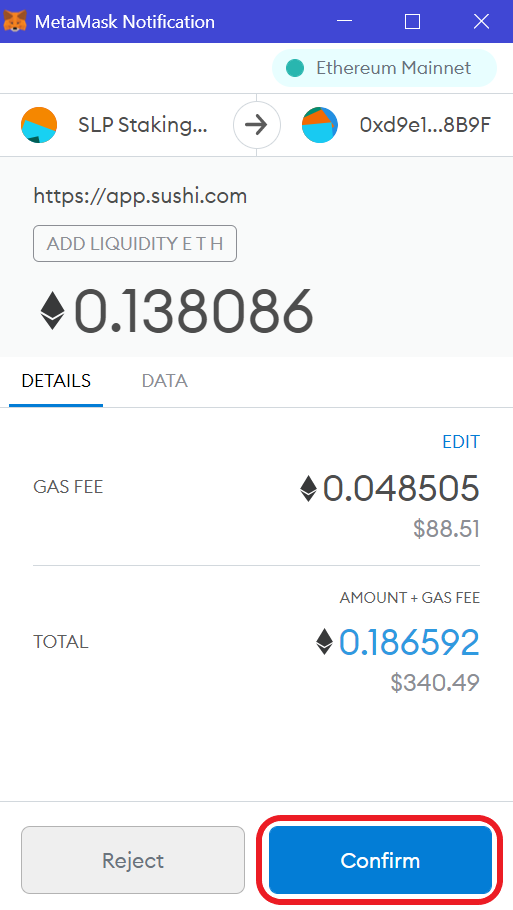

6. When MetaMask pops up, click “Confirm” once more.

7. When the Supply transaction is confirmed, your XFT and ETH will be placed into the SushiSwap liquidity pool, and you’ll receive SLP tokens in return. You won’t see the SLP tokens in your wallet unless you add the token by contract address (0xf39ff863730268c9bb867b3a69d031d1c1614b31) or view your address on Etherscan. However, it is not necessary to see your SLP tokens; if the transaction succeeds, you’re ready to move to the next step and stake your SLP tokens on our dashboard.

II. Stake your SLP tokens on the Offshift Staking Dashboard

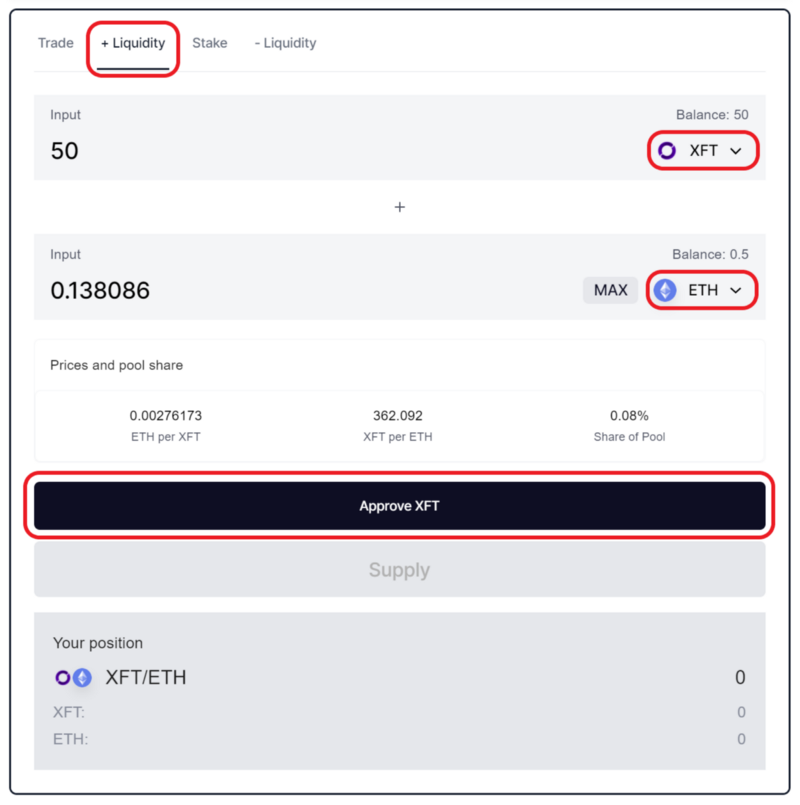

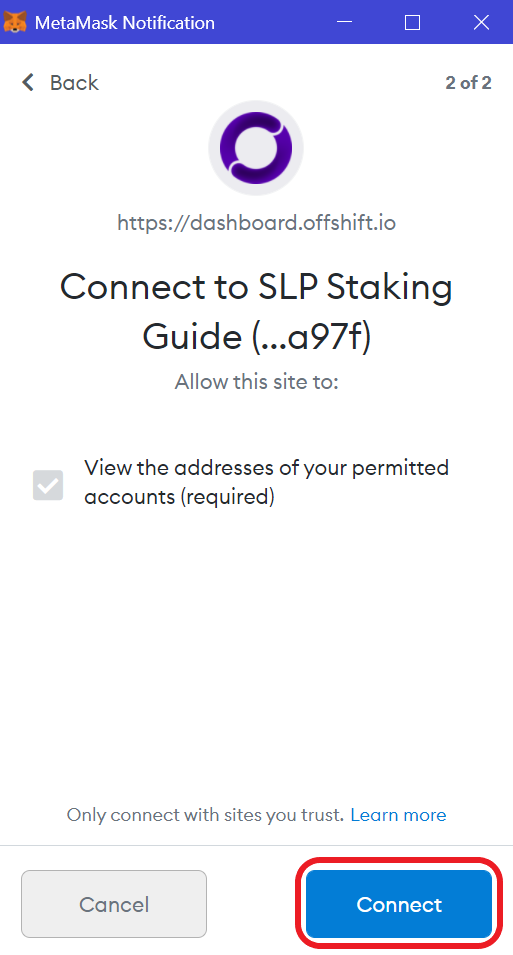

8. Navigate to the Offshift Staking Dashboard and click “Connect to Wallet.”

9. Select the wallet that contains your SLP tokens, and then click “Connect” to connect the dashboard to your wallet.

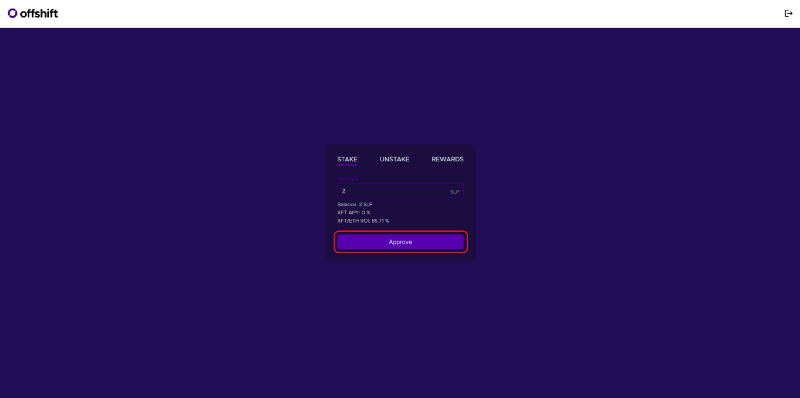

10. Enter the number of SLP tokens you wish to stake (generally your entire balance), and click “Approve.”

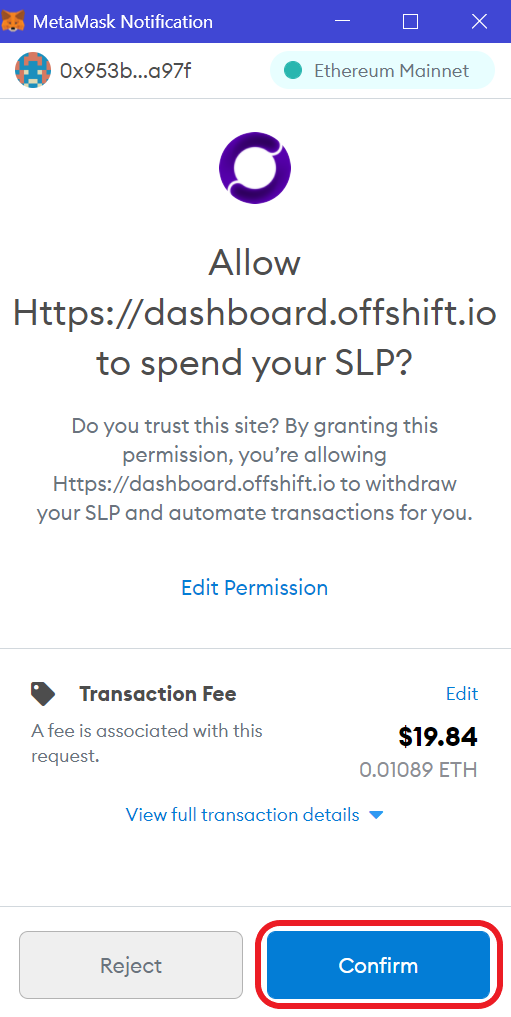

11. MetaMask will open and ask if you wish to Allow https://dashboard.offshift.io to spend your SLP? Click “Confirm.”

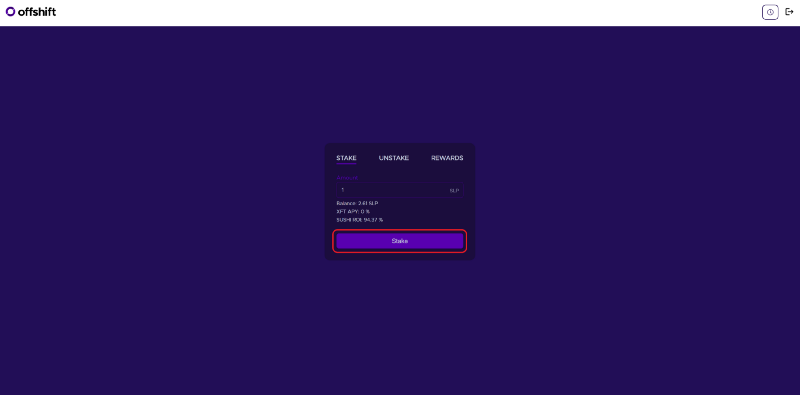

12. Once the approve transaction is confirmed by the network, you’ll have the option to stake. Click “Stake,” then “Confirm” in Metamask.

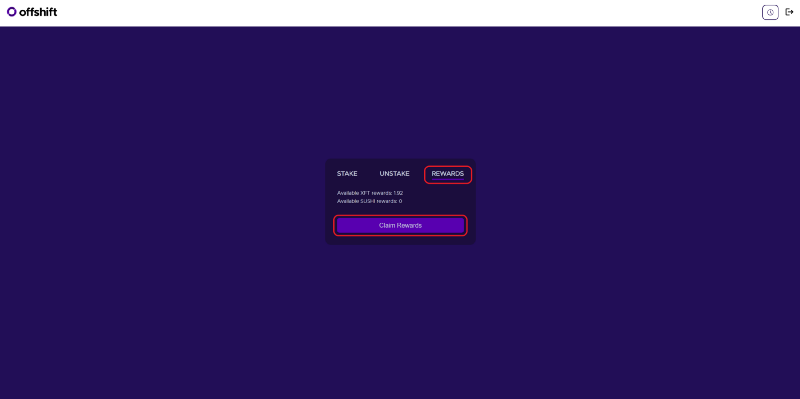

13. Once you’ve staked your SLP tokens via the dashboard, you’ll begin accruing rewards in both XFT and SUSHI. Rewards accrue every block and can be claimed at any time by navigating to the “Rewards” tab, clicking “Claim Rewards,” then approving the transaction in MetaMask.

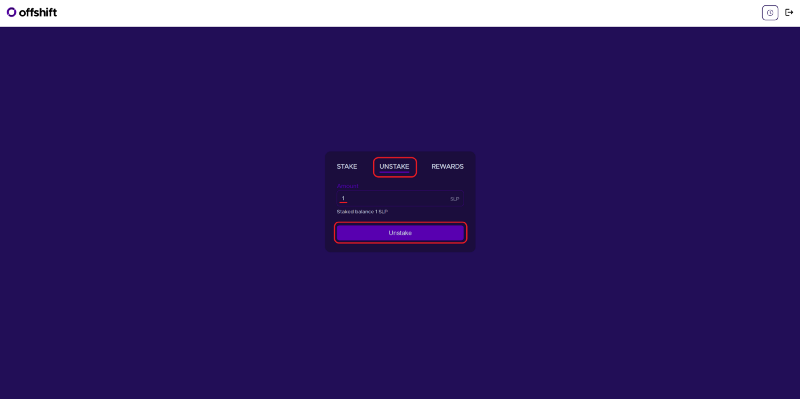

14. You can unstake or withdraw your SLP tokens from the staking contract at any time by navigating to the “Unstake” tab, entering the number of SLP tokens you wish to withdraw, clicking “Unstake,” and then approving the transaction in MetaMask.

If you have any questions about SLP staking, Offshift’s PriFi solution, or anything else, drop us a line in the official Offshift Telegram . Happy staking!

*Disclaimer: As with all applications of Decentralized Finance, engaging with Offshift’s staking platform necessarily involves risk. Users are ultimately and exclusively responsible for their assets, and should assess personal risk appetite and conduct their own due diligence in advance of conducting any investing activity. In addition, contributing liquidity to any decentralized exchange (DEX) necessarily exposes liquidity providers (LPs) to the risk of divergence loss (previously called “impermanent loss”). In the event of significant divergence between the values of two assets in a designated liquidity pool, LPs may incur net losses, and should fully identify their exposure to potential divergence loss prior to providing liquidity.

About Offshift

Offshift is leading private decentralized finance (PriFi) with the world’s first Private Derivatives Platform. It leverages zero-knowledge (zk) proofs and sources reliable, real-time price feeds from Chainlink’s decentralized oracle network to enable users to mint zkAssets, an unprecedented line of fully private synthetics. Offshift’s mostly anonymous team has developed a trusted reputation for their thorough privacy research, development and execution.

To learn more and get involved, visit the links below: